Are you struggling with customer files that are burdened with unstructured data, missing documents, or incorrectly categorized documents? Document recognition will help you restore chaos into order, improve the accessibility of your archive and ensure regulatory compliance.

Document Recognition (DR) technology combines various tools such as OCR, machine learning, and natural language processing to extract data from electronic documents.

DR can also analyze and validate information by cross-referencing files with digital data sources, making onboarding, monitoring and remediation easy as one two three.

Hyarchis’ Document Recognition is an AI-based application that enables you to take full control of your document repository. With Hyarchis Document Recognition, you can restore order from chaos by automatically identifying which documents are present in your customer files, which ones are missing, and which information may be clashing with GDPR regulations.

What are the benefits of Hyarchis Document Recognition?

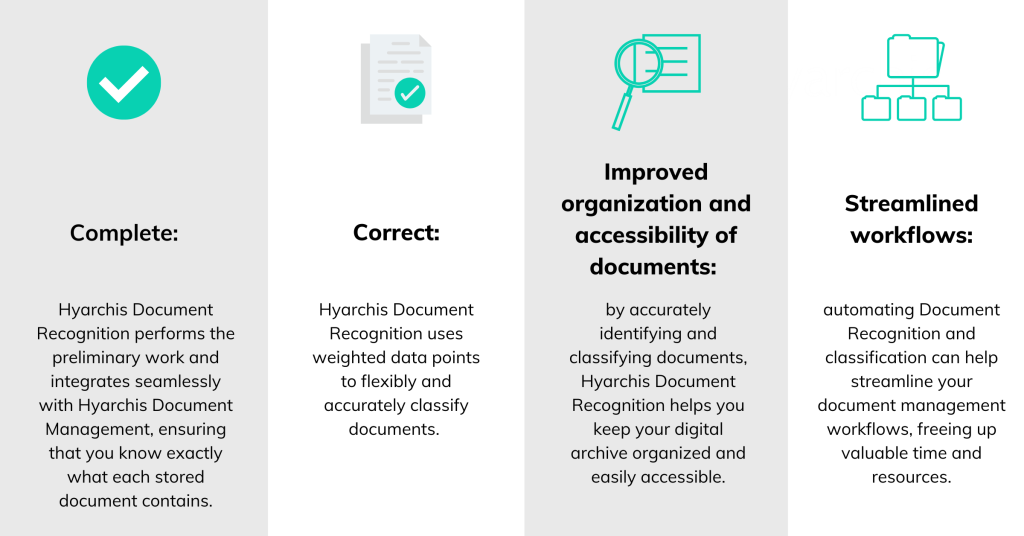

Hyarchis Document Recognition is an advanced solution that can revolutionize the way you handle your customer files. Let’s take a look at the main benefits:

- Accurately identifies and classifies documents: Hyarchis Document Recognition uses weighted data points to flexibly and accurately classify documents, ensuring that you know exactly what each stored document contains.

- Enables full automation of quality control procedures: Our Document Recognition solution offers full automation of your quality control procedures, reducing the risk of errors and ensuring that all documents are processed accurately and efficiently.

- Cost-effectively manages large amounts of documents: Whether you have a few thousand documents or several million, our technology can manage large amounts of documents cost-effectively, saving you time and money in the long run.

- Extensive coverage within the financial industry: Our Document Recognition solution is the trusted choice for banks, insurance companies, and other financial institutions.

- Provides a secure and compliant solution: Hyarchis Document Recognition complies with ISO 27001, ISO 27018 and SOC 2 Type 2 security standards, ensuring that sensitive information is always properly protected.

What can you use Hyarchis Document Recognition for?

Efficient Document Recognition is a critical aspect of many organizations. It allows you to extract more value form your client data, simplify customer onboarding and ensure compliance with KYC, AML and GDPR regulations.

At Hyarchis, we recognize the need for a streamlined solution. That is why we offer Hyarchis Document Recognition, an automated document classification tool that accurately identifies the document type, processes it automatically, and enhances it with relevant metadata.

Our cutting-edge Hyarchis Document Recognition feature enables businesses to optimize their document management processes. Here are some of the advantages that Document Recognition can provide your organization:

Conclusion

The growth of digital archives means that organizations are accumulating vast amounts of information. Storing correctly can be a challenge. Missing documents or privacy breaches can have serious consequences.

Hyarchis offers an automated Document Recognition solution that accurately identifies documents with a high degree of accuracy. By using Hyarchis, businesses can streamline their digital archive, gain a comprehensive overview of its contents, and improve business intelligence, customer service, and regulatory compliance.